Pre-Construction Land Facility

STRETCHED FIRST SENIOR DEBT

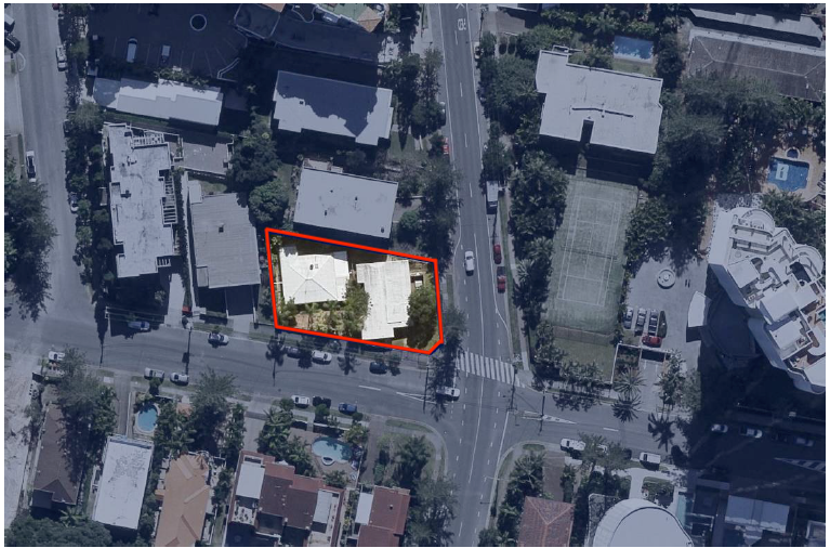

Nineteen, Surfers Paradise, QLD

Surfers Paradise, QLD

$150m

Gross Realisation Value

35

Luxury apartments

None required

Presales

June 2026

Estimated Completion date

The developer approached Optimus Capital to urgently refinance an existing $6 million first mortgage and secure an additional $1 million to repatriate capital to an equity investor.

The client also needed a further six months to negotiate the construction contract, secure additional pre-sales and continue exploring senior debt construction finance options.

Previously, the developer engaged another private lender and paid a non-refundable work fee, but the lender withdrew from the transaction before the refinance could be completed.

This resulted in the developer being vulnerable to potential default interest rates, losing millions of dollars of equity in sunk project costs (acquisition costs, holdings costs, planning, etc.) and an existential threat of losing a landmark development site.

Optimus Capital Partners, in conjunction with Fides Capital, secured first mortgage funding of $7m within 7 days, liaised with the outgoing mortgagee to manage their expectations and instill confidence that the refinance was imminent, while coordinating legal documentation with subsequent financial close of the facility occurring in September 2024.

The developer has commenced a sales and marketing campaign for an orderly sale of the property over a 6 month period.